Here’s How Much Digital Health CEOs Make in 2025

When you’re building a company, there’s always the question of how much you should pay yourself. The best way to fairly answer that question? Look at actual data.

I teamed up with my friends at J.Thelander Consulting to look at the compensation data, including both salary and equity, broken down by the amount of capital raised and industry.

In this article, I’ll walk you through what digital health CEO compensation looks like in 2025, how it has changed over the last few years, and how it compares to tech and biotech.

Note: Companies in the survey self-identify into categories including “digital health” and “healthcare IT”. We combined the two groups under the umbrella of “digital health” for this dataset.

Cash compensation depends on how much (and when) you raise

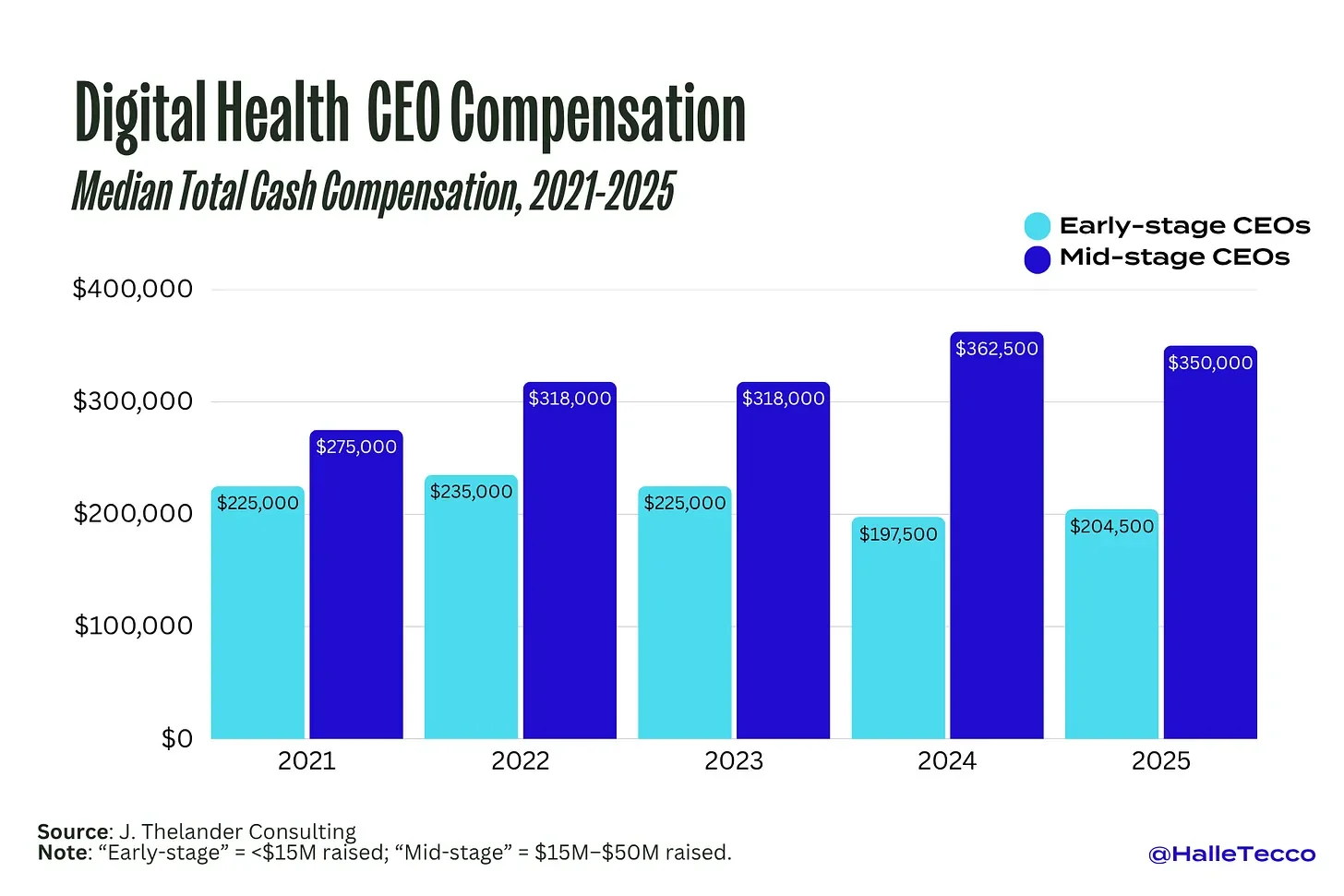

Across both tech and healthcare, CEO salaries scale with the amount the company has raised. In this dataset, CEOs at companies that have raised between $15–50 million (“mid-stage”) make 71% more in cash compensation than those at companies that have raised less than $15 million (“eary-stage”).

The gap between what early-stage and mid-stage CEOs make is widening. In 2021, the median salary difference was $50,000. Today, it’s nearly tripled to $150,000. That likely reflects growing expectations for mid-stage companies to have meaningful revenue and operational scale before raising larger rounds of funding. Meanwhile, early-stage founders are staying leaner for longer.

Early-stage CEOs (<$15M raised)

For companies that have raised less than $15 million, the median cash comp in 2025 is $204,500, with the 75th percentile at $271,260. That’s down 13% from the 2022 peak of $235,000.

Mid-stage CEOs ($15M–$50M raised)

For companies that have raised between $15 million and $50 million, median cash comp jumps to $350,000, with the 75th percentile at $493,750. That’s up 27% from 2021, when the median was $275,000.

One thing that stood out to me is that, even in a tighter fundraising environment, mid-stage CEO salaries are still rising. One reason might be that it’s simply harder to raise capital right now—so the companies that are raising tend to have stronger revenue. That added traction may give boards more flexibility to support higher salaries.

Equity is still where most of the upside lives

Of course, salary is just one piece of the equation. Most founders take far less cash than they could make elsewhere because they’re earning equity they hope will be worth something down the line.

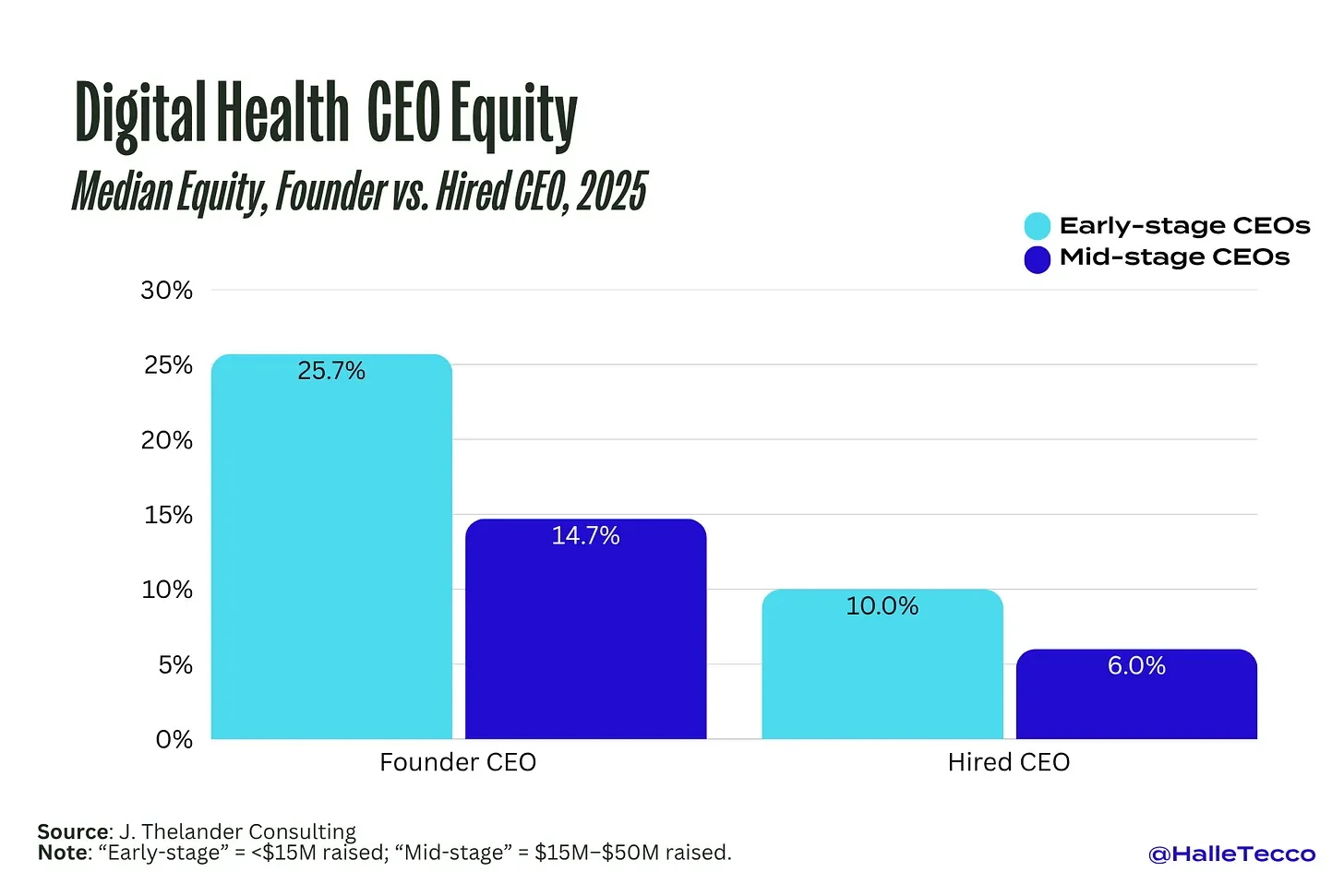

The J. Thelander data breaks down equity ownership by whether the CEO is a founder or was hired into the role. Not surprisingly, founder-CEOs own more of the company than hired CEOs.

At the early stage, founder-CEOs hold a median of about 25%. By the mid stage, that drops to 14.7%. Hired CEOs start with a median of 10% at the early stage, which falls to 6% at the mid stage.

This is a pretty steep drop-off, but it reflects how deals are structured. Startups trade ownership for access to capital. As companies raise more funding and valuations increase, founder (and employee and angel investor) equity gets diluted. But that dilution usually reflects progress—capital raised, team built, product launched, revenue generated. If the company eventually succeeds, even a smaller piece of a very large pie can be quite meaningful.

For hired CEOs, the tradeoff is different. They typically get a solid equity stake without bearing the same early risk, but their upside is often capped by how late they joined and how much capital the company has already raised. Still, for both founders and hired executives, equity remains the primary lever for wealth creation, and the biggest reason to bet on a high-growth company in healthcare.

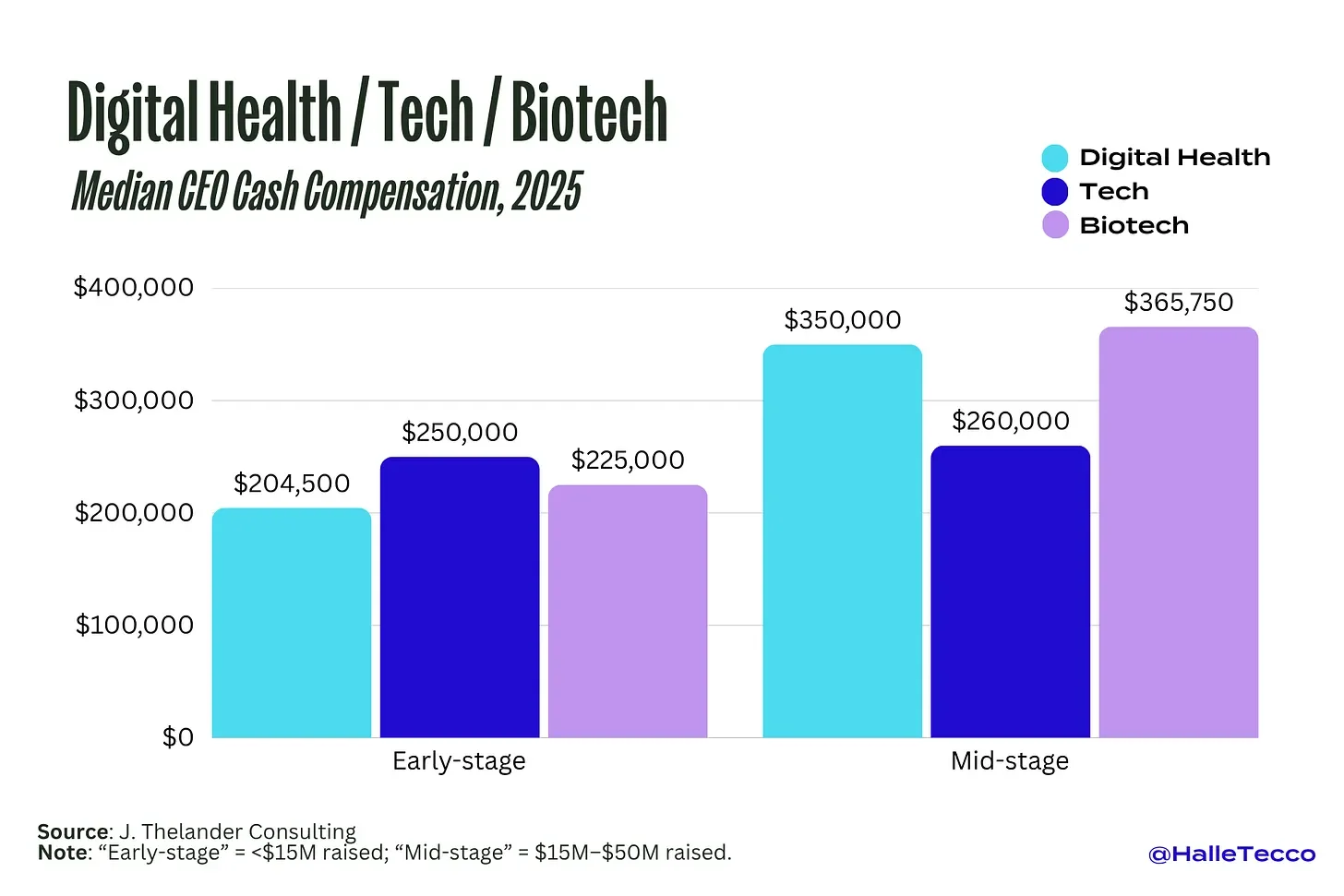

How digital health CEO comp compares to tech and biotech

So how does digital health stack up against other sectors? At the early stage, digital health CEOs earn the lowest median salary at $204,500, compared to $225,000 in biotech and $250,000 in tech. But by the mid-stage, that flips: digital health CEOs earn $350,000—more than their peers in tech ($260,000) and only slightly behind biotech ($365,750).

While digital health CEOs may start with leaner paychecks, compensation ramps up meaningfully as companies scale. It also reflects capital intensity: digital health may require less upfront investment than biotech, but once companies reach mid-stage traction, salaries start to align with broader healthcare executive norms.

Compensation is always a moving target, but seeing real data helps founders and operators calibrate expectations and make smarter decisions. Whether you're early in the journey or scaling up, it’s worth knowing what others in your shoes are actually earning. I hope this was helpful!

This is not a sponsored post - I’m a real customer via companies I work with, and grateful Thelander let me share this data. If you want access to real-time comp data like this, Thelander runs a no-cost Private Company Compensation Survey for founders and investors. The data is fully customizable and focused only on private companies, so you can actually compare apples to apples.